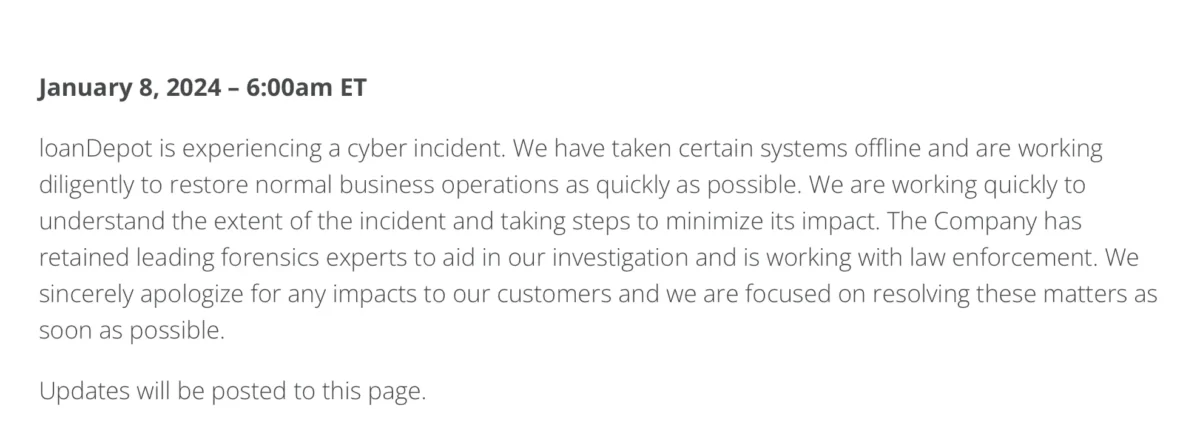

California, United States based company LoanDepot, a major US mortgage lender, faced a significant outage on Monday, January 8th, 2024, raising concerns about a potential ransomware attack. Here’s a breakdown of the situation.

The Incident:

- Outage: LoanDepot’s website and online services experienced extended downtime, impacting borrowers and loan application processes.

- Suspected Ransomware: The company confirmed “encryption of data,” hinting at a possible ransomware attack targeting sensitive borrower information.

- Limited Information: Details about the specific data compromised and attack vectors remain unclear as investigations continue.

LoanDepot, Inc. (the “Company”) recently identified a cybersecurity incident affecting certain of the Company’s systems. Upon detecting unauthorized activity, the Company promptly took steps to contain and respond to the incident, including launching an investigation with assistance from leading cybersecurity experts, and began the process of notifying applicable regulators and law enforcement.Though our investigation is ongoing, at this time, the Company has determined that the unauthorized third party activity included access to certain Company systems and the encryption of data. In response, the Company shut down certain systems and continues to implement measures to secure its business operations, bring systems back online and respond to the incident.

The Company will continue to assess the impact of the incident and whether the incident may have a material impact on the Company.

According to Filed with Securities and Exchange Commission (SEC) report,

Potential Impacts:

- Borrower Concerns: Loan applicants and existing borrowers may face delays in processing, communication disruptions, and anxieties surrounding data security.

- Financial Risks: Borrower data exposure puts them at risk of identity theft, phishing scams, and financial fraud.

- Regulatory Scrutiny: The incident is likely to attract increased regulatory scrutiny of LoanDepot’s cybersecurity practices and potentially the broader mortgage industry.

Industry Implications:

- Cybersecurity Vulnerability: The attack highlights the increasing risk of cyber threats targeting financial institutions and the need for robust security measures.

- Data Protection Concerns: The potential exposure of sensitive borrower data underscores the importance of data security protocols and consumer data protection.

- Consumer Confidence: Trust in the mortgage industry can be impacted by data breaches. Transparency and clear communication from LoanDepot will be crucial.

Next Steps:

- Investigation Ongoing: LoanDepot is currently investigating the incident and working to restore normal operations.

- Communication Focus: Clear and timely communication with borrowers and stakeholders is essential to manage the situation and rebuild trust.

- Cybersecurity Review: The cyber attack should prompt a thorough review of LoanDepot’s cybersecurity infrastructure and implementation of stronger protection measures.

This ongoing situation raises critical questions about data security in the mortgage industry. As LoanDepot investigates and recovers, borrowers should remain vigilant and consider monitoring their credit reports for suspicious activity. The industry as a whole should learn from this incident and prioritize robust cybersecurity practices to protect sensitive data and maintain consumer trust.

LoanDepot Hack: Key Takeaways for Borrowers and the Mortgage Industry.

For Borrowers:

- Data at Risk: While the full extent of compromised data is unknown, it could include borrower personal information (names, addresses, Social Security numbers) and financial details (loan amounts, payment history).

- Potential Impact: Borrowers whose data was exposed face an increased risk of identity theft, phishing scams, and financial fraud.

- Stay Vigilant: Monitor your credit reports for unauthorized activity and be cautious of any suspicious emails or calls claiming to be from LoanDepot.

- Contact LoanDepot: If you have any concerns about your data or unusual activity on your loan account, contact LoanDepot directly through verified channels.

For the Mortgage Industry:

- System Vulnerability: The attack targeted LoanDepot’s IT systems and payment portal, highlighting the need for enhanced cybersecurity measures across the mortgage industry.

- Data Security Concerns: This incident reinforces the importance of protecting sensitive borrower data and implementing robust data security protocols.

- Consumer Confidence: Data breaches can erode consumer confidence in the mortgage industry. Transparency and clear communication from lenders like LoanDepot are crucial to rebuild trust.

- Regulatory Scrutiny: The attack is likely to attract increased regulatory scrutiny of cybersecurity practices within the mortgage industry. Stronger regulations and data protection standards may be implemented.

Additional Points:

- LoanDepot reportedly faced ransomware attack, a malware that encrypts data and demands payment for decryption. This technique poses a significant threat to businesses and organizations globally.

- The attack also disrupted LoanDepot’s online payment portal, causing inconvenience for borrowers trying to make loan payments.

- While the full investigation is ongoing, this incident emphasizes the need for ongoing cybersecurity education and awareness for both borrowers and mortgage lenders.

By understanding the potential risks and remaining vigilant, borrowers can protect themselves from the fallout of such cyberattacks.

For the mortgage industry, this incident should serve as a wake-up call to invest in robust cybersecurity measures, transparent communication, and data protection practices to maintain consumer trust and protect borrower information.