Fintech application development services have been prevalent in the last decade. They are throwing a shadow over traditional banking! However, fintech app development services are not easy to execute. To hire fintech app developers for banking applications is a task of significant importance and requires careful consideration.

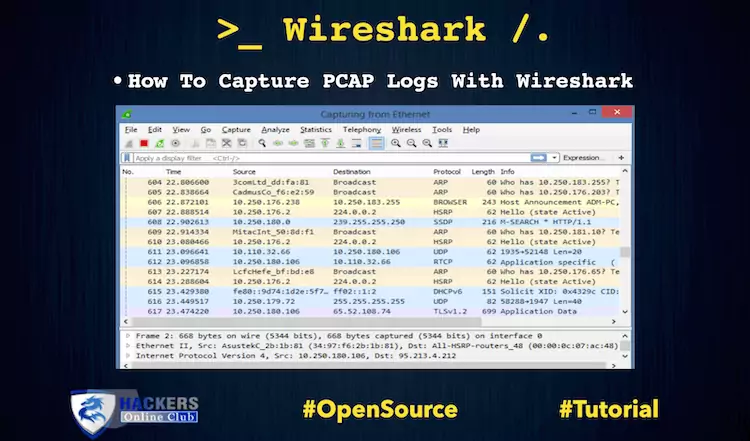

Cybersecurity has been a hot topic in the industry. Data leaks, identity theft, and draining bank accounts are not unicorn events, and unfortunately, they happen frequently. Fintech mobile app development services should focus more on protecting clients. Otherwise, they might lose customers.

What is the importance of cybersecurity services?

Finding a decent fintech mobile app development company is hard. Fintech companies are vulnerable to cyberattacks in more ways than one. In addition to the monetary loss, fintechs must also look at the ramifications of breached customer data, a loss of trust, and penalties for not maintaining compliance.

These attacks can cause more than just monetary losses. When customer data is breached, trust is lost, and fintechs can be slapped with costly penalties for failing to maintain compliance standards.

The financial sector is more important than ever in an increasingly digital world. As IBM researchers report, there has been a massive increase in cyber crime targeting the financial service industry. The easy accessibility of data and the rising number of employees using mobile devices to access sensitive information have made financial institutions even more vulnerable to attacks. Though financial service providers do not have to follow strict regulations like their banks, they must still take their cybersecurity seriously.

Data compliance

A fintech app development company should provide data compliance. Financial service providers have to keep it tight when it comes to managing PCI DSS and GDPR. Protecting customer data and managing risk are critical components of a financial institution’s cybersecurity plan.

Financial service providers must follow strict regulatory guidelines and there should be no compromise. Specific to compliance is the requirement to protect customer data; every business must have a sound data security plan in place and an employee training program geared toward data protection.

Reputation

Financial institutions have a responsibility to their customers, and it is an obligation that all brands must honor. With sensitive personal information and money at stake, security must be top-of-mind for businesses that handle personal data — or face the consequences. With your privacy threatened by data breaches and fraud, the way to repay customers is to show them that you’re on their side with proactive threat prevention technology.

Reputation cannot be your sacrificial lamb. Otherwise, your business will turn into a disaster.

How can cybersecurity services help?

Effective cyber security requires constant vigilance and the help of external experts. Because cyber threats are evolving, having a testing partner can keep your internal team on top of its game. An outside perspective will also help you stay up to date with new approaches to cybersecurity that could be both cost-effective and more secure than your existing strategy.

Cybersecurity threats are a legitimate concern, with cybercriminals going after businesses in the fintech sector every day. And even with all the right precautions in place, things can still go wrong — your website or one of your app’s pages might have security vulnerabilities that hackers can exploit, or you could become the victim of a phishing attack.

Summary

Businesses of all sizes need to protect themselves against cyber attacks. Large corporations can hire cybersecurity experts, but smaller startups may struggle to find affordable options. Luckily, most security products are available via subscription, meaning that companies can access affordable cybersecurity options without breaking the bank. Finding fintech application development services is not only a good move – it’s one for the future.