Digital Banking is evolving rapidly, with several advancements happening in the field daily. There are many benefits to these advances, but when it comes down to security there are always drawbacks. This blog post will explore how technology has both advantages and disadvantages when it comes to solutions in digital banking cybersecurity.

It seems like banks are constantly struggling with cyber-attacks and financial breaches, making this an important area for businesses and consumers alike. However, a few companies have stepped up their game lately and have gained more notoriety than ever before because of their innovations and best practices. However, even the most secure banks are still susceptible to attacks, like the recent case of Wells Fargo, which was accused of using fake accounts and opening fraudulent credit card accounts with customers’ identities.

To increase security of banking, businesses should implement good security practices and ensure that the proper precautions are in place before an attack occurs. Companies should also be wary about privacy issues as individuals have become more physically aware of their data. Businesses should be careful about what information they post online because a breach could hurt them financially. Banks should take into account these factors when creating their bank network security policies to protect both customers and stakeholders.

The importance for cybersecurity to online banking

Cybersecurity is important for internet users and businesses alike. Internet users need to be vigilant about their online security and make sure they are aware of the threats that are posed against them when using the internet. They should also be wary of emails and websites they visit, especially if they request any personal information.

These kinds of attacks are becoming more frequent and businesses need to apply strong security to protect against them. Without a proper security system, businesses could lose all of their client information, causing chaos in the financial industry. To combat these attacks and maintain proper data security in banks, businesses need to ensure that they have the right cybersecurity solutions in place.

The six best solutions to the threat of the cybersecurity in digital banking

Cybersecurity solutions are important to businesses and customers alike. Businesses will want to maintain their reputation and avoid future attacks, and cyber security solutions can help them do this. Companies should go through their security policies as well and follow them to the letter of the law.

They should also apply these digital banking solutions to protect themselves from attacks and any other potential privacy breaches that could cause harm down the road. Here are the best cybersecurity in banking solutions in digital banking which include investing in Next-generation endpoint protection, Multi-factor authentication, Machine Learning and big data analytics, End-to-end encryption, Anti-virus and Anti-malware applications, and Consumer awareness.

1. Invest in Next-generation endpoint protection

Endpoint protection is important for digital banking as it protects businesses from malicious threats, like malware and ransomware. These kinds of attacks are widespread, which is why companies need to take the proper precautions to keep their data and systems protected. Endpoint protection is also a good way for customers and businesses to stay protected on the internet as well.

2. Multi-factor authentication

Multi-factor authentication ensures that a user’s account information will not be easily stolen because they have implemented extra security measures on their sites. There are different types of multi-factor authentication, but it remains one of the most useful security solutions in digital banking today. When implemented correctly, multi-factor authentication can reduce cyber-attacks by a third, making it a good idea for companies to implement to protect their data and systems from hackers.

3. Machine Learning and big data analytics

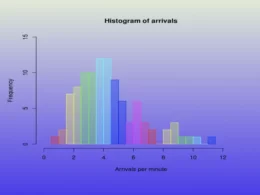

Machine learning is becoming more important as computers continue to get smarter. Big data analytics is relevant because it provides users with an extra layer of security by determining patterns in the information they collect on their systems that could indicate a need for security solutions. This is another important solution because it helps banks and other financial institutions protect against both internal and external threats.

4. End-to-end encryption

End-to-end encryption is a way to ensure that consumers will have their data protected by using secure connections, and only they have access to the information. When implemented correctly, it can prevent users from hacking or companies from stealing client information and stealing identities. Consumers will also appreciate these efforts because they will reduce the risk of becoming a victim of cybercrime.

5. Anti-virus and Anti-malware applications

Anti-virus and anti-malware applications are important for businesses in digital banking policy to protect any systems that could be vulnerable to attacks by hackers. These kinds of applications should be regularly updated with the most recent data available to ensure that businesses have a strong security system in place. This will provide the best protection against attacks and prevent any major loss of client information.

6. Consumer awareness

Businesses will need to make sure that they are educating their consumers on how online threats can affect them, especially if a breach occurs in their data systems. Customers should understand how certain information can be stolen, and what they should do if they become a victim of cybercrime. Businesses may also want to implement identity assurance programs to help customers feel more secure when taking out loans, using debit cards or holding accounts with them.

Conclusion

Digital banking is growing faster and more popular in the financial industry. There has been a change in the way people do their banking because it has made it easier for them to access their funds. Digital banks have also made it easier for them to avoid fees and maintain better control over their finances. However, digital banking also comes with increased risk, especially since there is still vulnerability to cyber attacks.

Companies will need to ensure that they are doing everything they can to protect themselves from hackers. They should implement security solutions, such as investing in endpoint protection software and using multi-factor authentication. Businesses should also use machine learning and big data analytics programs to help protect themselves from internal threats as well as external threats that could cause harm down the road.