The CashApp allows users to easily transfer money to one another using its app.

What is CashApp?

Cash App is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one another using a mobile phone app, and is also accepted as a legitimate payment method by select businesses.

What Happened With CashApp?

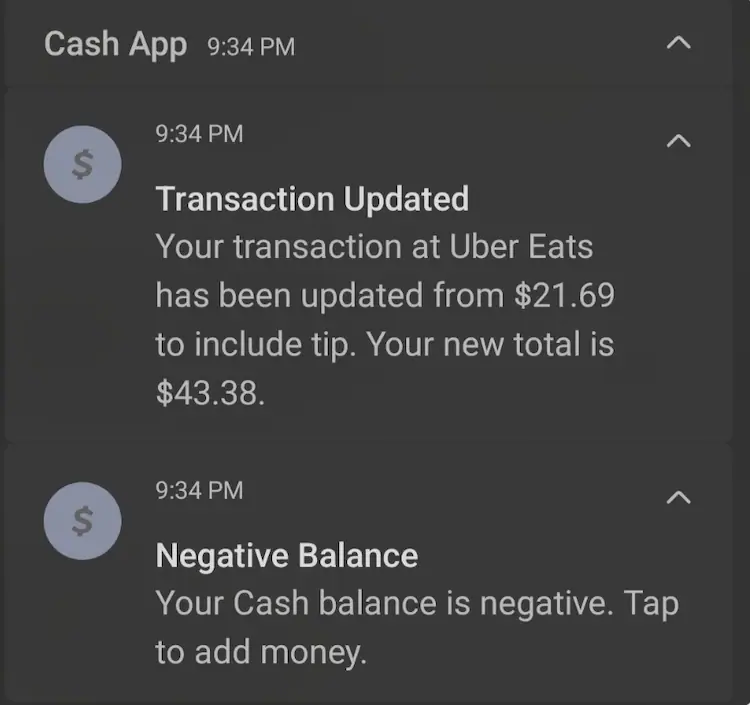

Some CashApp users are reporting that they are seeing negative account balance and transaction charges are double.

On Monday, Cash App announced that it is looking into a technical issue that is resulting in duplicated Cash Card transactions being processed, leading to some users having negative account balances. This matter requires urgent attention to ensure the fair and safe use of the platform.

On social media, users expressed their frustration that the Cash App had charged them twice the amount of their previous purchases. Many were upset that this mistake resulted in their account balances becoming negative.

What CashApp officially said,

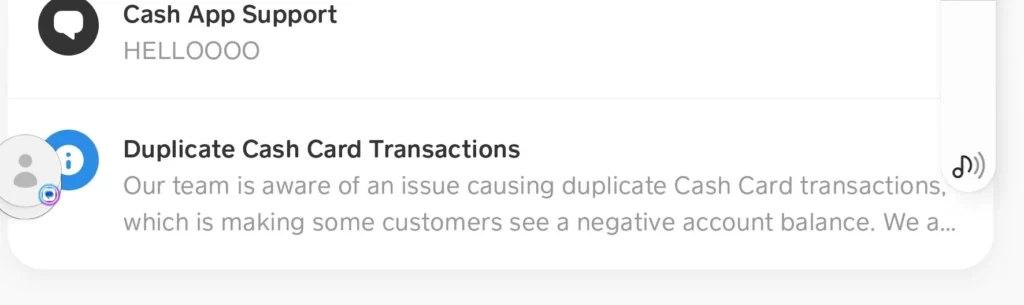

Duplicate Cash Card Transactions

Investigating – Our team is aware of an issue causing duplicate Cash Card transactions, which is making some customers see a negative account balance. We are looking into this matter and will post resolution updates here.

Support Down

Update – Our in-app support is back up and running. However, wait times for our in-app support may be increased right now due to phone support being currently unavailable. We appreciate your patience and will get back to you as soon as we can.

Investigating – We are aware that in-app and phone support is down, and we are actively working on this issue. We will post updates as soon as possible.

What Government Authorities said?

Recently, the Consumer Financial Protection Bureau (CFPB) cautioned consumers against keeping money in money-sharing apps like Cash App and Venmo for extended periods. This is because such apps do not offer the same federal protections as banks.

“Popular digital payment apps are increasingly used as substitutes for a traditional bank or credit union account but lack the same protections to ensure that funds are safe,” said CFPB Director Rohit Chopra. “